Quick Guide to Harmonization Codes: Helping your shipments move through customs

As you expand your online business to international markets, you will come across references to the Harmonized Commodity Description and Coding System (HS) or Harmonized Tariff Schedule (HTS) codes. These codes were created by the World Customs Organization (WCO) to help countries identify all items that are shipped into and out of their borders. The six digit codes classify products and commodities, and are used by virtually all countries in the world for customs and tariff purposes. Countries can add more digits to classify items in more details. However, the first six digits are the same across all participating countries. This standardizes the categorization of products which in turn, streamlines the customs process.

The process in which products are categorized or classified based on the HS and country-specific codes is called “harmonization”. Companies that ship a large number of items internationally often harmonize their products based on the various countries to which they ship. Very often expensive brokers are engaged to harmonize a company’s product line, because harmonization helps expedite the customs process at the destination country.

If you’d like to use HTS Codes for your shipments, Endicia makes it easy to find the codes for the products that you are shipping and include them on your international shipping forms. And you can do it without hiring an expensive broker! Even though the information is not currently required for U.S. Postal Service shipments, providing the codes may garner some measure of respect by the receiving customs authority.

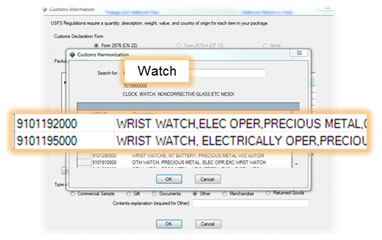

Both the DAZzle and Endicia Professional products have a convenient HTS code lookup tool. If your destination address is outside the U.S., when you select the “Print” command, you will see the “Custom Information” option. Double click on an empty column to bring up the lookup tool. Just type in the product, for example “watch”, and a number of entries come up. Read the detailed description of each line item and select the code that best matches your product.

Figure 1: Endicia's HTS code lookup tool

When you are ready to print, the HTS code will automatically be entered into the “HTS Tariff Number” field in the Customs Declaration form as shown in the sample shipping label below. Note that only the first six digits, or the internationally standardized numbers, appear on the form, as instructed by the U.S. Postal Service.

Figure 2: Customs Declaration form printed by Endicia

Navigating the ins and outs of HS or HTS codes are not as daunting as it appears — especially if you take advantage of Endicia’s innovative solutions for international shipments.